Chargebacks and friendly fraud represent a growing operational threat for direct-to-consumer brands. When customers dispute legitimate transactions, merchants face not only the loss of the original sale but also a cascade of fees, administrative costs, and potential payment processor penalties. Research indicates that chargebacks cost merchants $2.40 for every $1 disputed, with the multiplier effect coming from multiple fee layers beyond the original transaction amount, including refunded purchase amount, chargeback processing fees, and administrative expenses[1]. For brands operating with strong margins and significant revenue, these losses erode profitability and can trigger enforcement action from payment processors when dispute rates climb too high. This operational playbook examines the research-backed tactics that protect revenue without sacrificing customer experience or conversion rates.

Chargeback Rates and Industry Benchmarks

Understanding where your brand stands relative to industry norms provides the foundation for effective chargeback management. Industry benchmarks place average chargeback rates around 0.26% for e-commerce businesses, with rates consistently exceeding this level indicating deeper issues with fraud configuration or operational problems[2]. According to the Sift Q4 2025 Digital Trust Index, e-commerce chargeback rates climbed through 2025, reaching about 0.26% in the third quarter of the year as dispute rates increased, reflecting evolving challenges in payment disputes and fraud[3].

Broader industry research projects that global chargeback volumes will continue to grow, with an estimated 261 million chargebacks in 2025 and expected growth toward 324 million by 2028, highlighting the ongoing risk and cost associated with dispute management[3]. Payment processors charge merchants between $15 and $100+ per chargeback incident, depending on the card network, merchant's risk level, and agreement, with most processors charging between $15 and $25 per chargeback[4].

Buyers evaluating an e-commerce business will examine the rate of returns and chargebacks as part of operational due diligence, with rates substantially higher than industry norms indicating issues with product listings, fulfillment quality, sizing accuracy, or fraud prevention[3]. High chargeback ratios can trigger enforcement action from payment processors, with Shopify unofficially monitoring chargeback rates and taking action when rates approach 1% of transactions to protect themselves[5].

Visual representation of the chargeback lifecycle from initial order through resolution, illustrating key decision points where merchants can intervene to refund or contest disputes.

Friendly Fraud and Chargeback Types

Friendly fraud accounts for 36% of all eCommerce fraud cases, where real customers dispute valid purchases, including false 'item not received' claims, forgotten subscriptions, and buyers abusing refund policies[6]. Between 50% and 61% of chargebacks are due to legitimate transactions, making friendly fraud particularly challenging to combat, as banks usually side with the cardholder[6].

Merchants have a relatively low chargeback success rate, winning only 20-30% of disputes, primarily due to insufficient evidence or failure to respond within tight deadlines[7]. This reality makes prevention and early intervention more practical than fighting disputes after they occur. Merchants lose around 3% of total eCommerce revenue to fraud on average, with fraud losses rising to 5% of revenue in high-risk markets, while total fraud losses between 2023 and 2027 are projected to exceed $343 billion[6].

The Disputifier Security Incident

In the early hours of January 9, 2026, a major security incident struck the e-commerce world when Disputifier, a popular Shopify app designed to prevent and manage chargebacks, became the target of a sophisticated exploit that resulted in millions of dollars in unauthorized refunds across various merchant stores[8]. A 'rogue hacker' reportedly exploited a vulnerability related to API tokens within the Disputifier platform, allowing the attacker to bypass standard security protocols and trigger mass refunds on existing orders[8].

The Disputifier API Leak, where leaked API tokens enabled unauthorized refunds, is a reminder that even anti-fraud tools expand the attack surface, with merchants reporting losses of over $12,000 from their stores in seconds[9]. This incident illustrates the importance of vendor security audits and token management practices, particularly for apps with access to refund and order modification permissions.

Chargeback Prevention Strategies

Merchants who implement chargeback alerts see dispute rate reductions of 30% to 70%, as these services notify merchants when customers file disputes, giving them 24-48 hours to refund before it officially counts against their dispute rate[10]. This approach allows brands to resolve issues before formal disputes are recorded with payment processors, preserving dispute ratios and avoiding processor penalties.

Clear billing descriptors that customers instantly recognize can reduce 'unrecognized charge' disputes, with one real-world test showing a 62% reduction in dispute rates after optimizing statement descriptors like 'YourFitGear-Order#1234'[11]. Signature on delivery creates hard proof that the order reached the right hands, with carriers offering basic signature and adult signature options that fit different product risks, and showing this signed proof in a dispute often swings the decision in the merchant's favor[11].

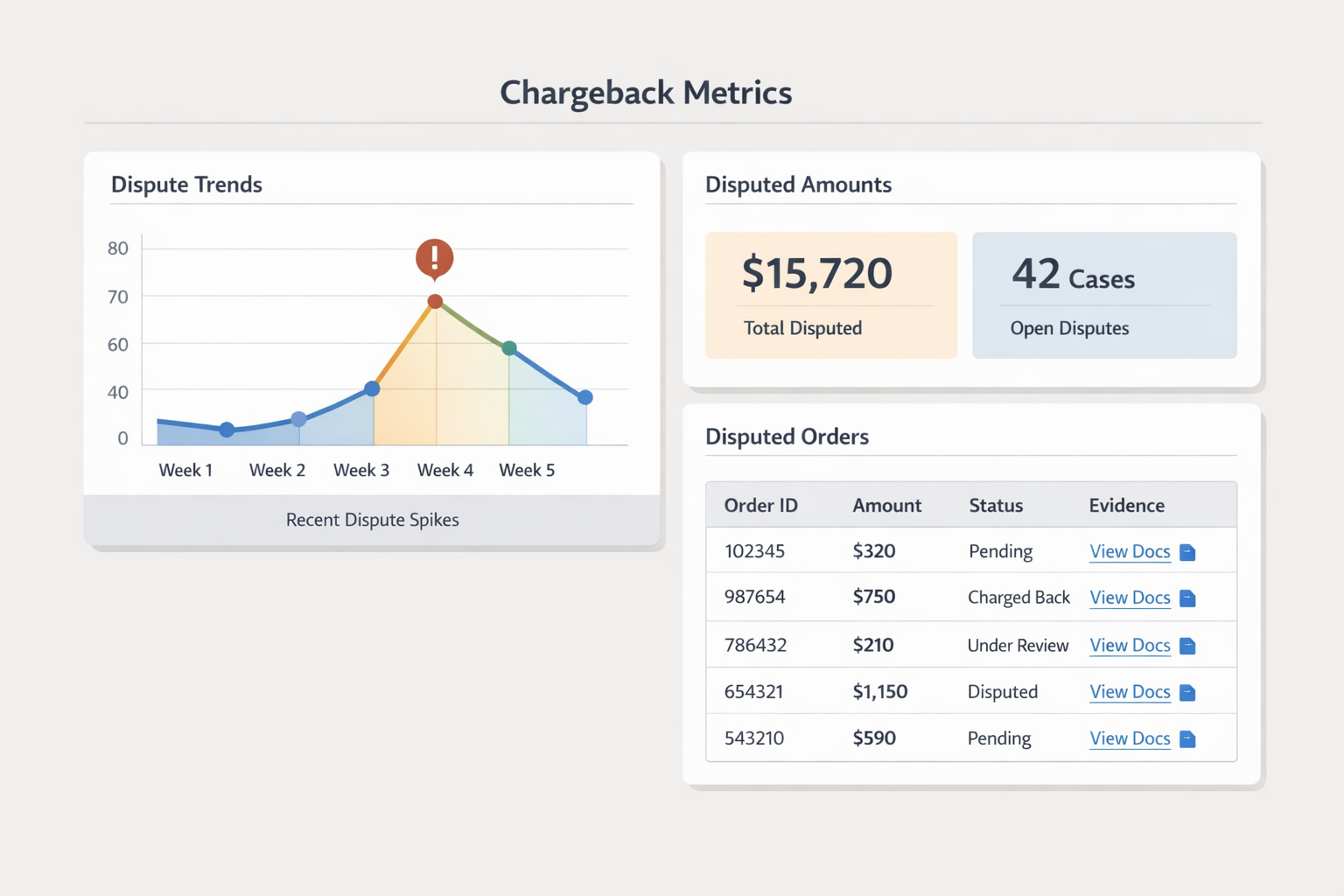

Example dashboard interface displaying chargeback spikes, disputed amounts, and direct links to evidence documentation for each order, enabling rapid response to dispute notifications.

AI and Technology Solutions

AI-powered fraud detection systems can reduce fraud by up to 40% through real-time fraud detection and a scoring engine that stops transaction fraud early, helping merchants reduce risk, chargebacks, and customer onboarding times[12]. Merchants using AI fraud detection can reduce false declines by significant margins, with Mastercard reporting that embedding generative AI across its fraud detection systems delivered up to a 300% improvement in detection rates[12].

3D Secure 2.0 can reduce fraud by up to 40% by allowing merchants to communicate with the cardholder's banks and vice versa, providing higher-level identity verification information than standard 3D Secure[13]. These technologies add friction to the checkout process, so brands may consider applying them selectively based on order value thresholds or risk scores rather than universally across all transactions.

Customer Experience and Refund Management

68% of shoppers won't return after a refund takes over five days, making slow refund processing a significant driver of customer churn and subsequent chargebacks[14]. Riskified's 2024 analysis of over a million refund claims found that 1-2% of total order value measured in sales dollars was requested back as refunds, with nearly 1 in 4 dollars claimed being abusive[14].

Across the dataset analyzed, nearly 12% of return attempts were flagged as high risk, with an average value of $120 per high-risk return, representing a meaningful source of revenue leakage, particularly for brands with higher average order values[15]. Brands may consider implementing risk-based return policies that require additional verification for returns above certain thresholds or from customers with patterns of frequent returns.

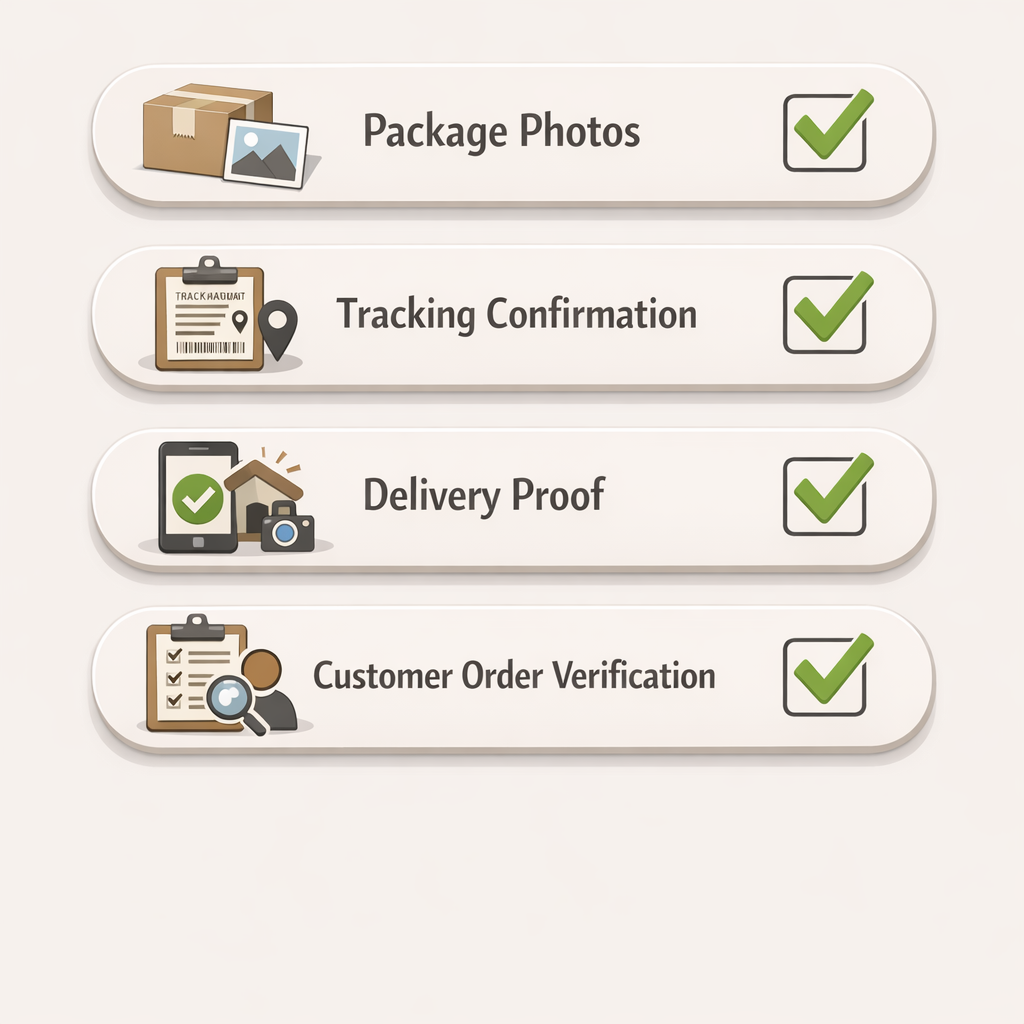

Checklist showing key evidence types to collect at fulfillment: package photos, tracking confirmation, delivery proof, and customer order verification.

Business Valuation Impact

Buyers evaluating an e-commerce business will examine the rate of returns and chargebacks as part of operational due diligence, with rates substantially higher than industry norms indicating issues with product listings, fulfillment quality, sizing accuracy, or fraud prevention[3]. Depending on the fundamentals of the e-commerce business, most companies will garner an earnings multiple of between 4.0x and 6.0x, so an e-commerce business with $4 million in annual earnings and a 5x earnings multiple achieves a valuation of $20 million[3].

As we mentioned before, high chargeback ratios can trigger enforcement action from payment processors, with Shopify unofficially monitoring chargeback rates and taking action when rates approach 1% of transactions to protect itself [5]. Maintaining chargeback rates well below processor thresholds protects not only current operations but also future business value and exit optionality.

Conclusion

Chargeback prevention requires a combination of detection systems, customer-first refund processes, and evidence collection practices that protect revenue while preserving customer relationships. Research shows that merchants who implement chargeback alerts see dispute rate reductions of 30% to 70%[10], while clear billing descriptors can reduce dispute rates by 62%[11]. AI-powered fraud detection systems can reduce fraud by up to 40%[12], and signature on delivery provides hard proof that often swings disputes in the merchant's favor[11].

Consider starting with the tactics that offer impact: implementing chargeback alert services, optimizing billing descriptors, and establishing systematic evidence collection at fulfillment. Audit your current chargeback rate against the 0.26% industry benchmark[2] and identify which dispute types account for the majority of your losses. For brands with rates above this threshold, addressing the most common dispute reasons may yield results.

How does your current chargeback rate compare to the industry benchmark, and which dispute types represent your largest source of revenue loss?

SUBMIT YOUR COMMENT